We have given a quick look to the September CPI release and concluded that the deflationary pressures in the economy have not disappeared, even if the headline rate of inflation has been positive for the past two month.

A feature of the commentary on the CPI is that it is supposed to give an indication of rising costs and inefficiency in the “state-controlled” sectors of the economy.

For example a piece in The Irish Times includes

Responding to the figures, Fine Gael spokesman on enterprise Richard Bruton said there was no sign consumer confidence had returned, while it was sectors where prices are regulated by the Government that continued to see upward pressure on prices.

The Small Firms Association (SFA) and the Irish Small and Medium Enterprises Association (ISME) criticised the Government for not tackling costs in the business sector and said further jobs would be lost if they are not brought under control.

Similarly from an article in The Irish Examiner:

Director of the Small Firms Association Avine McNally said the September inflation figures show inflation is being driven by increases in public utility costs, such as housing, water, electricity and gas.

And not leaving out this piece from The Irish Independent:

Avine McNally, director of the Small Firms Association, said public utilities were still driving up overall costs.

"Irish small businesses have taken harsh steps to regain cost-competitiveness, but any gains are negated by the costs imposed by the Government-administered sector," she said.

ISME, the Irish Small and Medium Enterprises Association, said state costs are continuing to cripple companies.

Chief executive Mark Fielding said: "It is vitally important that the root causes of the dramatic increases in production costs witnessed over the last number of years, including Government-controlled costs, are brought under control or else we run the risk of continuing to price ourselves out of the market.

And they are lots more piece like that out there. I gave a brief response to commentary like this when considering last January’s CPI release. The mistruths have continued. In the blogosphere Constantin Gurdgiev has a post on “Rip-off Ireland is Rearing it’s Ugly Head”. Constantin concludes that the numbers in the CPI:

are all signaling that we are living in a public sector boom times, as the Government seemingly pushes forward with the agenda of beefing up semi-states revenues at our expense.

I think there are lots of reason to discredit the public and semi-state sectors, but there is little evidence from the CPI to do this. I posted a comment to Constantin’s original post but given the further commentary published to today I feel compelled to add a bit more, but most of this comes from my contribution on Constantin’s excellent site.

For the business lobby above I will make one retort. The CPI is the Consumer Price Index, not the Business Cost Index. The CPI measures the prices consumer’s pay not the costs incurred by businesses. There may be some relationship between them but it is not accurate to draw the conclusions suggested above. The CPI is a weighted index based on the expenditure patterns of households. It does not reflect the spending or mix of spending of businesses.

We turn to the conclusions of Constantin Gurdgiev. He finishes

So good news then is that:

are all signaling that we are living in a public sector boom times, as the Government seemingly pushes forward with the agenda of beefing up semi-states revenues at our expense.

- State services, such as Education (+9.5% ! in 12 months);

- Banks payback to consumers for propping them up (CPI is up +0.5% yoy and ex-mortgages CPI is down -0.9% over the same period. So far, we have had, courtesy of our banks rescue plans: in a year to September 2009 mortgages costs fell 48%, in a year to September 2010 they rose 25.1%. All despite the fact that Irish banks are no longer facing higher costs of funding - instead they are simply borrowing from ECB using our bonds, for which you, me and our kids will be liable);

- State-set charges on energy (+8% yoy);

- State set health costs (+0.5%);

- Largely state-set or influenced transport costs (+1.4%)

Clearly, we've turned another corner, folks, and it's the 'Ugly Boulevard' ahead of us, consumers.

Here is my reply

The CPI is a measure of prices. For many of the services provided by the state sector a consumer price does not exist, hence the CPI offers no insight into the performance of most state sectors. I have previously addressed similar commentary.

You can see what is in the 'Education' sub-group in the following table.

Prices for private primary, private secondary, driving lessons and other training are largely outside the impact of the state sector. The huge amount of primary and secondary education services provided by the state make no appearance in the CPI. There is no price to measure.

It is notable, though, that almost half of the Education sub-group is prices in third-level education. The increase in registration fees is driving the 20% inflation in this sub-category (and the 9.5% inflation in the overall education sub-group). This is a state- controlled price. This increase entered into the October 2009 CPI, and with registration fees largely unchanged in 2010 this increase is about to fall out of the CPI.

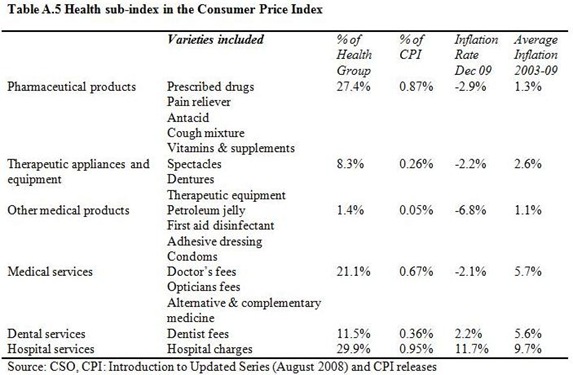

Some details of the The health sub-group of the CPI can be seen here.

Again, it is driven by consumer prices rather than state costs. Obviously the state has a huge role to play in the health sector but one can only infer an indirect effect on the medical goods, drugs and services prices measured by the CPI.

The most recent OECD statistics show health care expenditure makes up nearly 9% of GDP. The health sub-group of the CPI has a weighting of just over 3%.

The Energy sub-category may be up by 8.0% year-on-year, but again these are not "state-controlled costs".

Electricity (-1.3%) and Natural Gas (-10.6%) are both down on the year. The increase in this category is almost completely down to inflation in petrol (+11.9%) and diesel (+17.0%). Some of this is down to government (carbon tax) with another portion due to external factors (commodity markets).

Finally, the claim that the 1.4% inflation rate in Transport costs is "state-set or influenced" is again wide of the mark.

Nearly 88% of the Transport sub-group comes from the Purchase of Vehicles and Operation of Personal Transport Equipment. As with the Energy sub-group the positive inflation rate in the Transport group is largely the result of increases in petrol and diesel prices. The only other significant annual increase is in air transport (+16.1%). These prices are largely outside the state sector.

State-controlled rail and bus transport make up only 4.6% of this sub-group (and only 0.6% of the overall index) and both are essentially unchanged on the year.

There is lots of useful information in the CPI but support for "an agenda of beefing up semi-state revenues" is not part of it.

No comments:

Post a Comment