The Department of Finance has just released the Exchequer Statement for September. The relevant documents are:

The Minister for Finance is buoyed by the latest figures.

In the period to end-September, tax receipts were on target, at €22.2 billion. As anticipated, the year-on-year rate of decline in tax revenues has continued to ease since the end of 2009. At end-September, tax revenue is down 6.5% year-on-year.

The Exchequer figures show the public finances have stabilised due to the decisions taken by the Government. Stabilising the public finances is essential if we are to protect existing jobs and create new ones. Today’s Exchequer figures show we are on the right path towards economic recovery.”

While the year-on-year comparison is still negative, it is true that the relative decline on 2009 is at its lowest level all year.

The rapid declines of over 17% seen in the first two months of the year have gradually eased as the year has progressed. The annual decrease to September of –6.5% is actually better than the Department’s overall predicted drop for the year of –7.1%. This is shown in the graph below. The red dashed line represents the Department’s 7% predicted drop in tax revenue. The green dashed line is my (now pessimistic?) predicted drop of just over 10% in tax revenue.

The positive turn on these figures comes from what appears to be a strong performance of tax revenue in September. Whereas August was €330 million or nearly 16% down on the same month last year, September recorded an offsetting increase of €333 million or over 11% on the same month last year.

Before looking for the source of this increase we will give a look at the performance of the individual tax headings for the first nine months of the year.

The €1.5 billion drop in tax revenue compared to last year is driven by three of the four main tax headings: income tax, VAT and Corporation Tax. Of the big four only excise duty is hanging on to last year’s levels (which were pretty abysmal to begin with). The tax heads up on their 2009 returns are stamp duty and customs duty and these are relatively insignificant rises.So why was September’s tax revenue up 11% on last year?

This is as positive as this monthly comparison has been all year. After been behind for each of the first eight months of the year, September was the first month this year when Income Tax receipts were up on 2009. Even with this gain Income Tax is still over half a billion down on last year. See table here.

Half of the €333 million increase for September is due to Corporation Tax which was up €167 million or over 90% on the amount collected in September of last year. Corporation Tax receipts have yo-yoed in recent months and in August were over 60% down on the 2009 figure. For the year to date Corporation Tax is still over €400 million down on last year. See table here.

Relevant as all of this might seem, much of the media focus will be on the performance of tax receipts to the Department of Finance ‘targets’. This is comparing a real number to an imaginary number. The headline is that “tax take on target after nine months”. This is actually true but this is a low hurdle to begin with.

By the end of September tax revenue is ‘only’ €42 million or 0.2% behind the Department of Finance forecasts. The monthly forecasts from these figures can be seen here. Tax revenue for August and September has been ahead of the Department’s forecasts.

While the overall forecast is pretty much spot on, the Department’s forecasts of the individual taxes that make up the total are a bit more erratic.

At €337 million, Income Tax is substantially behind the projected figure but more than two-thirds of this is offset by the 12% or €235 million gain on Corporation Tax compared to it’s target. It is noteworthy that €159 million of the excess Corporation Tax collected came in September when Corporation Tax receipts were 83% ahead of the forecast amount. See table for monthly September forecasts here. In August Corporation Tax was another €48 million or almost 30% ahead of forecast. Table here.

It is these Corporation Tax receipts that are giving the overall tax revenue figures their positive sheen (when compared to targets). It is hard to know if these increases will be maintained. They could be down to timing issues as companies pay their preliminary tax and we could see reduced Corporation Tax revenues paid in the next few months as companies may have already paid most of their 2010 tax liability. Of course, it could be that the Department just made overly pessimistic forecasts for August and September and that comparisons to these numbers are largely meaningless (which they are!).

Corporation Tax is over €400 or 16% down on last year so there is not much reason to be cheerful because we are ahead of target. The timing issue may not be completely irrelevant as Corporation Tax is actually €65 million or 3% ahead of the equivalent 2008 figure, when every other tax head is down in this comparison and total tax revenue down over 20%. Table here.

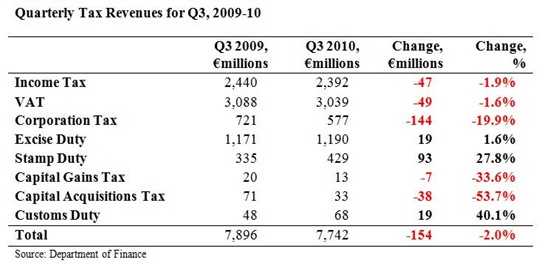

One final actual comparison we can do with the September figures is to make a quarterly comparison as we now have the numbers up to the end of the third quarter.

Again, the overall figure is down on last year as was the case in both the first quarter and second quarter. However, most of the decline in the third quarter can be attributed to Corporation Tax. Again, it is hard to know whether this reflects timing issues or a continuing deterioration in Corporation Tax receipts.

One pattern worth noting over the first three quarters of the year is the relative easing in the rate of decline in Income Tax receipts. For the first quarter of 2010, Income Tax was 10.4% down on 2009, in the second quarter this had slowed to 6.5% and as we can see above in the third quarter Income Tax was “only” 1.9% down on last year. Thus, while Income Tax is down €513 million on last year, €466 million of this drop occurred in the first six months of the year.

Here are the graphs for those fatigued of tables. Click smaller images to enlarge.

No comments:

Post a Comment