The Central Bank have released the Credit, Money and Banking Statistics to the end of October. (Release here, data here). A couple of trends have remained consistent.

We’ll start with total private sector credit.

The total amount of credit extended to Irish residents has been falling since the middle of 2008. The small ‘jump’ seen for January 2009 was when the loans offered by credit unions were included in the Central Bank’s measure of private sector credit. Private sector credit peaked at €375 billion in October 2008. In September it had fallen to €285 billion and this fall continued in October when it was €280 billion, a level not seen since June 2006.

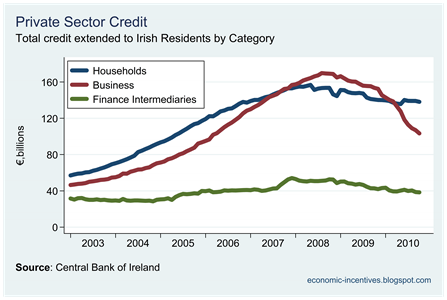

Here we break the above total into lending to households, non-financial corporations (business) and financial corporations.

The biggest drops have been in the business sector which has seen the total amount of credit extended fall from €170 billion at the peak in mid-2008 to €103 billion now. The quantity of loans extended to business since the start of 2009 paints a telling picture.

Some of this decline may be due to the transfer of developer loans from the banks to NAMA but a significant portion of it is due to a contraction in the amount of credit available to businesses. Here we look at the category of loans extended to business.

Although the totals in all categories of loans extended to businesses have been falling, the fall in 2010 for loans issued for up to 1 year has been very dramatic. This has fallen by 42% in the first ten months of the year, from €49 billion in January to €28 billion now. NAMA is not good for all of that. Working capital for firms is getting scarcer and scarcer. If only they had the ECB to act as an ‘lender of last resort’ to tide them over.

In the household sector some 80% of loans are mortgages, and for the past two years or so repayments on existing mortgages have been greater than the amount of new loans issued.

Although we do have a huge arrears problem we do have a lot of household meeting their mortgage obligations and more. The amount of outstanding mortgages peaked at €128 billion in May 2008. These balances are now down to €108 billion. It must be noted that most of this fall occurred up to the end of 2009 when mortgage balances stood at €110 billion. This was the primary destination of our €11 billion of household savings in 2009.

In the first 10 months of 2010 mortgage balances have fallen by €2 billion. Unless household deposits are rising rapidly this suggests we can expect a dramatic drop in the household savings rate in 2010 from its 12% level in 2009.

So on that let’s look at deposits. Not good.

Since the start of 2010, household deposits have fallen by about €3 billion. With total loans to households down by one €1 billion over the year (from €139 billion to €138 billion) this indicates that Irish households are dissaving in 2010. This is not because they are borrowing to fund consumption, but that they are drawing down savings to fund consumption.

If we look at the ratio of household deposits to household debts we see a ratio that improved through 2008 and 2009 but has deteriorated this year. The credit boom during the middle part of the decade is clearly visible as household debt soared.

Of course, there are number of caveats to the above ratio. Firstly, this is an aggregate measure. It is likely that the subset of households who hold the €96 billion of deposits is a different subset to those who are carrying the €138 billion of loans. The indebtedness of many households in Ireland is enormous. Secondly, the decline in deposits in Irish banks could be a reflection of the ongoing crisis our banks face and it may be that people are not necessarily using up their savings but transferring it to banks in other countries.

The banking crisis is having an effect on the category of deposits used by households. Households are less willing to have their money tied up in accounts which can have maturities of up to two years. Accounts with notice periods of no more than three months are seeing more money placed into them.

Finally, here are the total deposits of Irish businesses since January 2009. Businesses are being squeezed on all sides with credit falling as we have seen above and the graph below showing that the amount of deposits businesses have access to also falling.

No comments:

Post a Comment