The release of the Non-Financial Institutional Sector Accounts prompted us to the consider the Household Sector. In a subsequent post we looked at what we had done with the close to €12 billion we had saved in 2009. It is clear that this money was used to pay down debt rather than build up deposits.

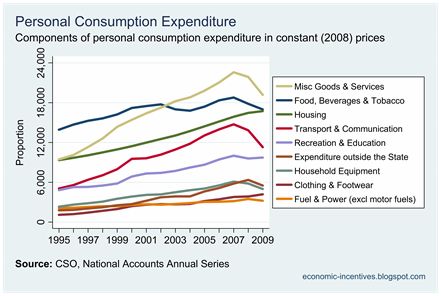

We now turn to an examination of the money used for personal consumption expenditure. In 2009 personal consumption was €84.3 billion down from a peak of €94.8 billion in 2008. In nominal terms these are increases from the €29.7 billion in personal consumption expenditure in 1995. Here is the pattern of the nine components of consumption expenditure in current prices as reported by the CSO since 1995.

The graph shows dramatic increases across a number of sectors, particularly food, housing, transport, recreation and education. The largest increase over the 15 year period is seen in the category labelled miscellaneous goods and services. The effect of the recession is most visible in the miscellaneous, housing and transport and communications categories, all of which recorded drops of more than 10% in 2009.

Using current prices it is clear that some of these changes in nominal consumption could be due to price effects. Here is the same graph using constant prices.

Looking at the aggregate figures is reasonably information but it is probably more intuitive to look at the relative proportions of the components of personal consumption expenditure, i.e. the proportion of consumption was devoted to each category.

The stand-out feature of this graph is the drop in the proportion of expenditure that goes on food, beverages and tobacco. The category comprised 29.6% of expenditure in 1995. This had dropped to 18.8% by 2008, though increased slightly to 20.2% in 2009. The breakdown of this category can be seen here. The sub-category food (excluding meals out) has fallen from 14.0% of consumption in 1995 to 8.9% in 2009. The other sub-categories have also shown declines in the proportion they comprise of consumption: non-alcoholic beverages (-0.2%), alcohol (-2.8%) and tobacco (-1.3%). This reduction in the amount of our income we have to devote to food expenditure was the subject of a previous post.

With less of our expenditure devoted to the food, beverages and tobacco category we used a greater proportion of consumption on housing (as a proportion up 4.6% from 11.9% in 1995 to 16.5% of consumption in 2009), miscellaneous goods and services (up 4.4% to 22.3%) and expenditure outside the state (up 2.4% to 6.8%). There are no sub-divisions provided for the housing and expenditure outside the state categories, and the rather inconclusive sub-categories of the miscellaneous category can be seen here, though there does appear to be an increase in the proportion of consumption on health services. It is also worth noting that the housing category does not include mortgages as these are treated as investment expenditure.

The only other category for which notable sub-categories are provided is the transport and communication category which up 13.2% of consumption expenditure in both 1995 and 2009 though it had risen to 15.7% in 2006. The breakdown of this category can be seen here which shows a sharp decline in expenditure on personal transport equipment (down from 6.1% in 2000 to 2.4% in 2009) in the last two years with expenditure on communication showing a steady increase (up from 2.0% in 1995 to 3.3% in 2009).

[ASIDE: One side issue that this analysis raises is the weighting given to the group ‘Motor Trades’ in the CSO’s Retail Sales Index. Across the year this category makes up about 23% of the Retail Sales Index. Within this group 82.2% of the weighting is given to the purchase of vehicles. This would indicate that the purchase of vehicles has a weight of about 19% in the Retail Sales Index.

The consumption figures explored here suggest in 2005 (the year in which the Retail Sales Index weights are based) that expenditure on personal transport equipment made up 4.6% of total consumption expenditure. Although the Retails Sales Index only deals with the purchase goods while the consumption expenditure data cover goods and services this would not to sufficient to close the gap. If expenditure was split evenly between goods and services this would suggest a weighting of 9.2% for the purchase of vehicles. Why then is the weighting over twice as large at 18.9% in the Retail Sales Index?

Could it have to do with how vehicle purchases are financed, i,e, cash versus finance?]

UPDATE: A little thought suggests a possible answer. Figures in the Retail Sales Index are likely to include only the value of the car sold. This is a measure of turnover which is the total value of sales. Personal consumption expenditure is likely to be the value of the car purchased less the value of any trade-in used as part of the deal. The measure of expenditure is likely to be the amount spent above any trade-in value. Q.E.D?

No comments:

Post a Comment