The tax returns for October were released earlier today. The relevant documents are:

The early headlines are positive with the information note from the DoF stating that “the overall Exchequer position for the first ten months of the year means that the Budget Day targets remain valid.” At first glance it does appear that the possible good news we saw in September’s figures has carried through to October.

The drop in tax revenue relative to last year continues to ease and at 5.3% was the lowest annual drop seen this year. When looking at the monthly revenues, we can see that October followed on from September’s increase and was €135 million or 5.6% on the tax revenue collected in the same month last year.

By looking at the performance of the individual tax heads we can see the breakdown of the €1.4 billion tax shortfall relative to last year.

All the main tax heads (Income Tax, VAT, Corporation Tax, Excise Duty) are down on last year. The largest absolute drops are in Income Tax and VAT which combined are over €1 billion down on last year. Of the top four tax heads the largest relative decline is in Corporation Tax which is 7.3% down on last year. Excise Duty has the smallest absolute and relative declines of the main tax heads and is still clinging to last year’s levels.

So where did the €135 million increase in tax revenue for October come from?

This doesn’t paint the positive picture the aggregate figures suggest. The key driver of the upturn in October was a surge in Corporation Tax receipts which were 92% ahead of the 2009 figure. If we exclude Corporation Tax the other seven tax heads shown a decline of €83 million or 3.8% of the €2.2 billion they brought in last year.

This is the second month in a row in which Corporation Tax receipts were 90% ahead of the 2009 figure. See here. It is difficult to determine if these increases will transfer into an increase in the amount of Corporation Tax corrected for the year or whether they are down to timing issues as companies make their preliminary tax returns.

In September, monthly Income Tax receipts has shown the first annual increase for 2010. However, this was quickly reversed in October and as we can see Income Tax receipts were 5.0% down on last year’s figures. See full table here.

As per usual, much of the focus will not be on the true comparison of 2010 tax revenues to 2009 revenues, but on the false comparison of 2010 tax revenues to the Department of Finance forecasts.

And indeed it is true. Tax revenue is now €243 million or 1.0% ahead of Department of Finance targets. Every time you hear this remember that compared to last year tax revenue is down €1.4 billion or 5.6%. Here are the monthly figures that have gotten us to the ‘positive place’

Tax revenue has been ahead of Department forecasts for each of the past three months which has brought about the 1.0% increase. If we sum the past three months, the DoF predicted that tax revenue would fall by 4.7% compared to last year while the outturn has revealed that for these three months revenues rose by 1.9% compared to last year.

The main reason for taxes coming in ahead of target is the unexpected surge in Corporation Tax receipts which are now 22% ahead of target. Five of the eight tax heads are now ahead of target with the notable exception being the poor performance recorded by Income Tax.

In October alone Corporation Tax was €238 million (121%) ahead of target. See here. Excluding Corporation Tax the other sum of the other seven tax heads is behind target and we do not yet know how permanent these increases in Corporate Tax revenues will be.

The Information Note provided by the Department states that “a shortfall in DIRT receipts in the month of October accounts for a large proportion of the overall income tax shortfall.” Income Tax is €361 million behind target. I cannot see how DIRT receipts in October can have much to do with that. To September, Income Tax was already €337 million behind target. We do not have details of these DIRT receipts in October but their impact on the “shortfall” of Income Tax receipts must be limited when 93% of the shortfall had occurred before the start of October.

[A report by Sean Whelan on RTE news stated that the shortfall in DIRT receipts was of the order of €150 million. If this is true it would suggest that Income Tax receipts outside of DIRT, performed quite well possibly maintaining September’s gain.]

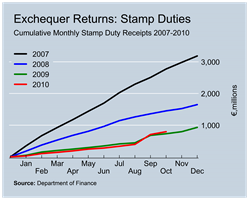

Here are the graphs (click smaller images to enlarge):

No comments:

Post a Comment