One of the notable features of the recent quarterly national accounts has been the upturn in GNP as show below.

GNP has now grown quarter-on-quarter for the past three quarter. This was not enough to generate an yearly increase and 2010 GNP of €135.3 billion was down 2.1% of the €138.2 billion recorded in 2009.

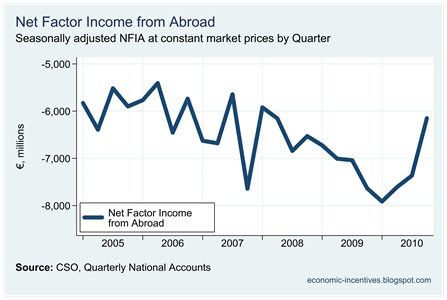

The difference between GDP and GNP is ‘Net Factor Income from Abroad’. This is the balance of income abroad that is repatriated to Ireland and income in Ireland that is repatriated abroad.

Towards the end of 2009 nearly €8 billion more was leaving the economy. It can be seen that by the end of 2010 this has fallen rapidly and in the final quarter of 2010 just over €6 billion left the economy in seasonally adjusted terms. The upturn in the non-seasonally adjusted series is even more dramatic. See graph here

To see the actual amounts that underline this net amount we can see the flows of money from the balance of payments. With labour compensation flows being very small the key variable is investment income. Here are the investment income flows in and out of Ireland.

This investment income is further divided into direct investment income, portfolio investment income and other investment income. Although the latter two of these are significant there has not been much volatility in these series recently. The main changes has occurred in direct investment income.

The big drop in outgoing factor income in the latter half of 2010 can be seen here, though it also apparent that the current quarterly level is close to the average seen in the period since 2005. The greatest portion of direct investment income is income on equity. The flow of equity income is divided between “dividends and distributed branch profits” and “reinvested earnings”.

In the early part of the series there seems to be a strong negative relationship between the two. When dividend outflows are large, reinvestment outflows are small (and were even negative when dividend outflows peaked in 2005). In the last two years this relationship has broken down. It appears that outflows from reinvested earnings in late 2009/early 2010 were higher than would have been the case had this apparent relationship held. This increase in reinvested earnings outflows was not maintained and there was a big drop towards the end of 2010.

Could it be that the surge in reinvestment earnings outflows up to the middle of 2010 over-stated the true drop in GNP and that the fall in these over recent quarters has seen a more accurate reflection of Irish GNP? That is, things may not have been as bad we thought they were for 2009 GNP figures and things now may not be as good as they appear to be for 2010 GNP figures. Just a thought.

What this highlights is the major effect a small number of massive multinationals have on Ireland’s National Accounts. Remember the stat that 10 companies account for 34% of total Irish exports?

Update: The CSO give a related explanation in the QNA release.

On the Expenditure side the decline in net exports of multinational companies compared with the third quarter resulted in a substantial decrease in profits thereby reducing the overall net factor outflows and feeding in to the quarterly GNP increase of 2.0 per cent.

They know more about the activities of the multinationals through their ‘large case unit’ they can publicly release. Therefore we will have to accept the link between the “decline in net exports” and the “substantial decrease in profits”. Rising GNP should be a good thing but not if it comes from falling net exports and profits. The impact of a small number of the large multinationals on out national accounts is huge.

Could the decline in profits have anything to do with this?

No comments:

Post a Comment