We previously looked at the balance sheet position of deposits in Irish banks (all banks here and the ‘covered’ banks here). While no one disputes that Irish banks are losing deposits, the actual rate of decline is subject to question due to the non-consolidated method the Central Bank uses when compiling the Banking Balance Sheet tables in the Money, Credit and Banking Statistics.

This means that if an Irish bank moves deposits in an internal intra-bank transfer or between subsidiaries it could appear that it is losing deposits if this transfer is to a non-Irish subsidiary. There have been suggestions that about 75% of the apparent €18.5 billion loss of deposits in the covered institutions that occurred in January is due to such transfers. As we have noted most of the changes in deposits in Irish banks has occurred in the ‘Other Financial Intermediaries’.

What we will look at here are private sector deposits of Irish residents. This figures will be changed by the actions of depositors rather than the bank that holds the deposits. First up, are total private sector deposits of Irish residents in banks in Ireland and these are definitely falling.

In August 2009, private sector deposits totalled €187 billion. The January 2011 total is €167 billion. The Central Bank breaks this down into deposits by four sectors:

- Households

- Non-Financial Corporations

- Financial Intermediaries

- Insurance Corporations

Deposits across all sectors are falling. Here we isolate Household Deposits. Between January 2010 and January 2011 these fell from €99.5 billion to €94 billion and are on a largely unbroken downward trend.

Across the different deposit options available to households we see that the decrease has been driven by a fall in long term deposits as we can see here.

Deposits in accounts that need more than 3 months notice and mature in less than two years have fallen from €37 billion in January 2009 to €28 billion. This could be caused by falling interest rates but we do not see an increase across the other categories, so these deposits have not been replaced (in Irish banks).

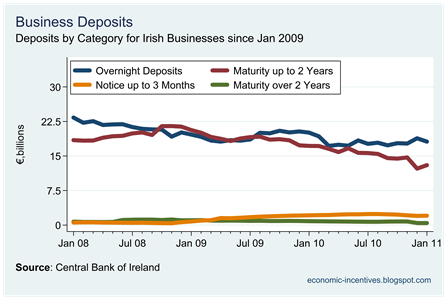

On the business side we see a similar drop in deposits.

Again it appears to be long term deposits that are driving the fall in deposits.

No comments:

Post a Comment