Here is a graph that shows the approximate proportion of income tax paid by each income decline (the first decile are the lowest 10% of incomes reported to the Revenue Commissioners, the second decline are the next 10% of incomes and so on). These figures are approximate as the Revenue do not provide individual level data and they are calculated using the income ranges used in the Revenue’s Annual Statistical Reports.

The gradual shift of the income tax burden can be seen. Back in 1997, the top income decile paid 46.1% of the total income tax. By 2008 this had increased to 60.1%. The proportion of income tax paid by all other deciles has declined with the largest relative falls seen in the lowest deciles.

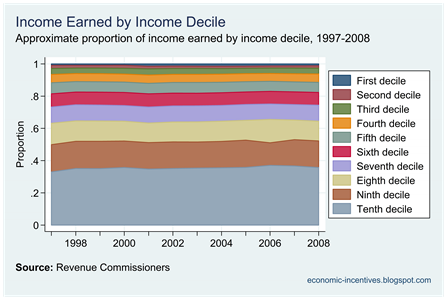

Of course, it could be that the tenth decile is paying a greater proportion of the income tax because they are earning more of the income. Here are the approximate proportions of income earned by the same deciles.

The proportions show the unequal distribution of earned income but are remarkably stable. In 2000 the top decile earned 35.7% of the gross income reported to the Revenue Commissioners. In 2008 the proportion was 35.7% – absolutely no change. Much the same holds for all income deciles.

No comments:

Post a Comment