The words finally and slowly could be added to the above question but the Q4 2012 Quarterly Financial Accounts released yesterday by the Central Bank suggest that some minor improvements are occurring, though the needle is far from leaving the red zone. The CB’s data is here and the information release on the Q4 update is here.

On the liability side, household sector loans have been declining since late 2008.

Long-term loans are those that had an original maturity of more than one year. Since 2008 short-term loans (less than one year maturity or repayable on demand) have declined from €13.4 billion to €6.4 billion. The €174 billion of outstanding loan liabilities of the household sector is roughly comprised of:

- Owner-occupied mortgages: €111 billion

- Buy-to-let mortgages: €31 billion

- Credit card debt: €3 billion

- Credit union loans: €6 billion

- Other consumer debt: €23 billion

These are gross figures and we know that a lot of loans issued during the credit boom will never be repaid in full and dealing with those has been unacceptably slow. Yesterday’s release indicated that there was €0.4 billion of household loans written off in Q4 2012. It is not clear where this happened but the sub-prime mortgage lenders which have combusted are a likely candidate. By September 2011, nearly 60% of the €2 billion of mortgages issued by the sub-prime lenders were already in 90 day arrears.

The primary reason for the reduction in the nominal amount of loan liabilities of the household sector is net loan repayments: repayments on existing loans exceed drawdowns of new loans. Although total loans have fallen by €30 billion over the past few years this has not translated into an improvement in the usual measures of debt sustainability. This is because of the drop in household disposable income that occurred over the same period.

Here is the disposable income of the household sector as measured in the CSO’s Institutional Sector Accounts. This reflects the household sector as a whole and not simply those carrying the loans shown above. The income drops in that subset could have been larger or smaller than those shown below.

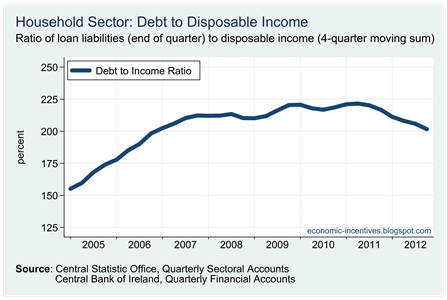

Anyway, combining the loan and income data gives the following.

Although, loan liabilities in nominal terms began to fall in late 2008 the debt-to-income ratio continued to rise through 2009 and 2010 and peaked at 222% in the second quarter of 2011. It has since fallen for six quarters in a row and stood at 202% at the end of 2012. This is a welcome fall of 20 percentage points but the ratio is still very elevated and has only returned to mid-2006 levels.

The reduction has been helped by the increase in gross disposable income which is measured as:

Self-employed/mixed income + wages + net property income – taxes and social and social contributions + social benefits and other transfers

Here are the figures for the household sector since 2008.

Household income in 2012 was boosted by an almost €2 billion increase in self-employed income, a slight rise in nominal wages while net property income benefitted from the ECB interest rate reductions in late 2011 which reduced the interest paid on loans by more than the interest received on deposits (after the FISIM – Financial Intermediary Services Indirectly Measured – adjustment was made). The various components of Other transfers (non-life insurance, fines and penalties, inter-household transfers, lotteries etc/) can be read about here (click red right arrow on page to progress).

As well as an increase in the flow of (nominal) income, the stock of wealth in the household sector is also increase. We have seen the reduction in loans which was the key contributor to the €8 billion reduction in financial liabilities over the year. Financial assets increased slightly over the year.

Much of the increase in 2012 is down to the net equity of households in life insurance reserves which increased from €62 billion to €71 billion over the year. As well as that household deposits have begun to edge up, rising by €3 billion over the year.

The Central Bank estimate that the value of housing assets held by the household sector continued to fall in the early part of 2012 but was largely static since then. Adding the figures for financial assets and housing assets and subtracting financial liabilities gives the following picture for net household wealth.

After 17 consecutive quarters of decline, net worth of the household sector has risen in the past two. Of course, the increase is derisible compared to the collapse which preceded it but it is a move in the right direction. And it should go without saying that this aggregate analysis of the household sector offers no insight into the huge disparities that exist between the ongoing experiences of individual households.

No comments:

Post a Comment