At the time of Budget 2013 back in December the Department of Finance projections indicated that the Consumption Expenditure component of GDP would decline by 0.5% in real terms in 2013. The Department has revised their projections in the 2013 Stability Programme Update published yesterday.

On Consumption the SPU (page 12) says :

Consumer spending held up relatively well at the end of last year, and core retail sales have been reasonably strong in the early part of this year. Slightly better-than-assumed labour market conditions and the likelihood of lower-than-anticipated inflation will also support consumption which is now projected to increase by 0.2 per cent.

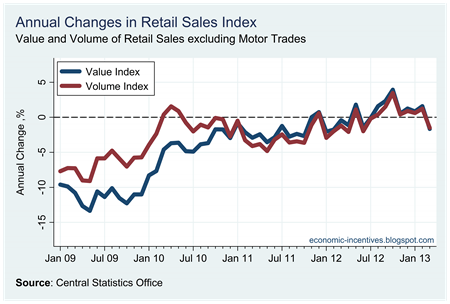

Have core retail sales been “reasonably strong” to lend support to this revision from –0.5% to +0.2%? If one looks at the annual changes in the series there does seem to be some support for this.

From August 2012 to February 2013 the annual change in both the value and volume of core retail sales was positive, though provisional data indicate that this was reversed in March. But the series of 12-month changes can obscure what is happening now. Here are the index values for the series (scaled with January 2010 = 100).

It is clear that the most recent figures are far from cheery. After been largely flat through 2011 and the start of 2012 core retail sales did show a reasonably strong rise from July to October last year (helped in part by the digital switchover) but have now reversed all of those gains and have shown monthly declines for four of the past five months. In the first three months of 2013 core retail sales have not been reasonably strong; they have been weak.

The motor trades are excluded from core retail sales but are included in Consumption (c. 4%). How have they been faring out?

Down 8% on 2012, though there is the possibility that the new 131/132 license plate system will push more of this year’s sales in the second half of the year.

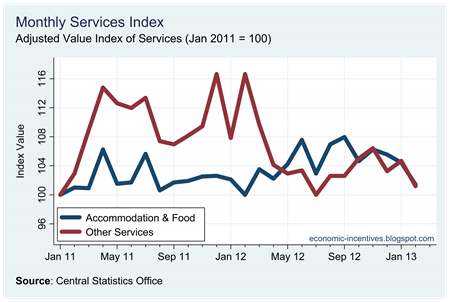

And finally there is consumption on services. The is no Retail Sales Index equivalent for services but the CSO have begun producing a Monthly Services Index which looks at all services, rather than just those purchased by consumers. From that we can extract two series which may be useful here.

- Accommodation and Food Activities

- NACE 55 Accommodation

- NACE 561, 562 Food Services Activities

- Other Services

- NACE 68 Real estate activities

- NACE 92 Gambling and betting activities

- NACE 93 Sports activities and amusements and recreation activities

- NACE 95 Repair of computers and personal and household goods

- NACE 96 Other personal service activities

Both are heading in the wrong direction and Other Services are well below the levels seen at the start of last year, though this didn’t last beyond April. The volatility also suggests that short-term trends can be quickly reversed. It should also be noted that these are value or nominal series whereas the discussion up to now as been on volume on real series. The CSO hope to progress to producing a volume index in the future. The sample for the services index is also worth noting:

The sample size is approximately 2,100 enterprises. The sample comprises a census of all enterprises with an annual turnover value of more than €20m or enterprises with more than 100 persons engaged. The remainder of the target population is stratified using 2-digit Statistical Classification of Economic Activities in the European Community, i.e. NACE Rev. 2 classifications. Each of these 2-digit NACE sectors are further subdivided into strata based on turnover. A simple random sample is then drawn from each stratum. Retail and Motor Trade figures are taken from the separate Retail Sales Index sample of approximately 1,400 enterprises.

All told, there is little thus far in 2013 to indicate that retail sales have been “reasonably strong”. Maybe there will be a minor boost from tomorrow’s ECB Governing Council meeting …

No comments:

Post a Comment