We have now had three years of so-called austerity budgets in Ireland that have focussed largely on expenditure cuts. So how much has expenditure being cut by? Lets start with gross expenditure by central government.

At first glance it would appear as if the austerity measures are beginning to bite. After showing a continual rise to 2009, gross central government expenditure fell from €75.3 billion in 2009 to €69.1 billion in 2010. However let’s break this down by Voted and Non-Voted expenditure. Voted expenditure is essentially the money allocated to government departments and offices. Non-voted expenditure is money that is spent under specific legislation and does not require a separate ‘vote’.

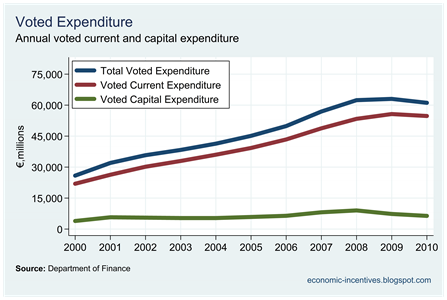

Since 2008 the increase in voted expenditure has moderated and actually decreased slightly in 2010. However, most of the decrease in gross expenditure that occurred in 2010 is due to non-voted expenditure. So called ‘budgetary cuts’ on voted expenditure have had little effect so far in tempering expenditure, with any reduction seen mainly in voted capital expenditure as shown in the next graph.

In fact, if we look at breakdown of total expenditure into current and capital expenditure we see that all of the decrease can be attributed to capital expenditure. There has been no year when day-to-day or current expenditure has fallen. None.

When looking at non-voted expenditure it is clear there has been no actual cuts in expenditure. It is the result of some once-off events in non-voted capital expenditure.

Non-voted current expenditure (mainly interest payments on the National Debt) has been increasing since 2008. The apparent reduction in non-voted expenditure seen in 2010, is simply due to the once-off increase in non-voted capital expenditure that occurred in 2009. In 2009 there was €4 billion transferred to Anglo Irish Bank and €3 billion paid to the NPRF to fund the recapitalisations of AIB and BOI. These payments did not occur in 2010 (and most bank recapitalisations since have been off-balance sheet).

On the current side there has been some reduction in voted current expenditure but this has been more than offset by the increase in interest payments that is pushing up non-voted current expenditure. Any ‘savings’ being made on current expenditure are more than offset by expenditure increases elsewhere.

The one area where there has been actual reductions is in capital expenditure. We saw above why non-voted capital expenditure spiked in 2009 and fell sharply in 2010. Voted (or departmental) capital expenditure has been cut sharply since 2008 and in two years has been reduced from €9.0 billion to €6.4 billion.

Cutting, or just hiding, capital expenditure is the ‘low-lying fruit’ of an austerity package. It does not offer sufficient long-term reductions if order is to be restored to the public finances. Closing a €19 billion budget deficit requires expenditure cuts and tax increases. Thus far we have grasped neither nettle properly.

Delaying capital projects like road improvements, new railways, metros and other public construction projects does not ‘save’ money as most of these are projects will have to undertaken at some point in the future anyway. A properly implemented austerity programme has to look to cut current voted expenditure. The main elements of this expenditure are transfer payments, public sector pay and pensions, and expenditure on goods and services. The 2010 figures suggest we have seen little austerity so far and it is too early to forecast the impact of the changes announced in Budget 2011.

The budget deficit remains (and is actually getting bigger!). Is there anyone who will grasp the painful nettle?

No comments:

Post a Comment