Although the headline inflation figure shows inflation jumping to 1.3% in December, this does not reveal the full nature of price trends in the Irish economy. In December alone, the CPI rose by 0.20%. However, if we just taken energy prices out of the index, this measures shows that prices fell by –0.23% in December.

Energy products make up less than 8% of the overall index and these prices were inflated in December due to the increases in Excise Duty that came into effect on the night of the Budget early in the month. Excluding these somewhat artificial price changes, though they have a real effect, we see that prices fell in the month.

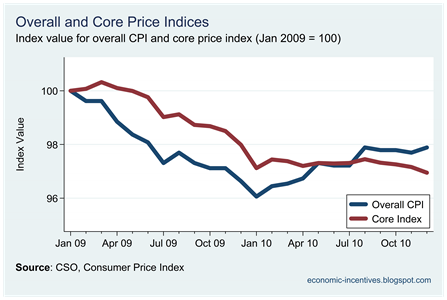

Looking at our comparison between overall and core inflation which excludes the effect of energy products and mortgage interest and reflects 85% of the overall index we see that core deflation remains and is easing very very slowly.

If we look at the original index value we can see how the overall and core measures of inflation are beginning to diverge.

It is clear that after a period of stability up to August 2010 that prices as measured by our core measure of inflation have been continuing to decline.

No comments:

Post a Comment