The CSO released the November External Trade statistics earlier today and we will consider them in due course. The dominant category of our merchandise exports is the Chemicals and Related Products category which now accounts for nearly 60% of goods exports from Ireland. We will use the Annual Business Survey of Economic Impact from Forfás to examine the size and contribution of the Chemicals Sector to the Irish Economy.

First up is the key graph – exports in the chemical sector and the level of direct expenditure (payroll, goods and services purchases) in the Irish economy. Mind the gap!

In the ten years from 2000 to 2009 chemical exports, in the Forfás sample, increased from €18.2 billion to €37.7 billion, an increase of 107%. Over the same period the direct contribution from this sector to the Irish economy from €2.1 billion to €3.1 billion, an increase of 48%. As a percent of exports of the direct expenditure from this sector in the Irish economy is just 8.2%. Exports can soar in this sector (and they have) but there will be little impact felt on the ground of this “export-led growth”.

Now we will work through the sector in a little more detail. First up total sales. There is an Irish Chemicals sector there I promise. Look closely. Sales in 2009 from Irish-owned companies at €412 million make up just over 1% of the €39.7 billion total sales in the sector.

In fact, looking at sales is a little redundant as exports make up 96% of sales, though this figure is 57% for Irish owned companies. The only a negligible difference between the total sales graph above and the total exports graphs below.

Although Irish firms only make up 1% of sales they do manage to contribute 7% of the direct expenditure in the Irish economy from this sector (€235 million versus €3,113 million).

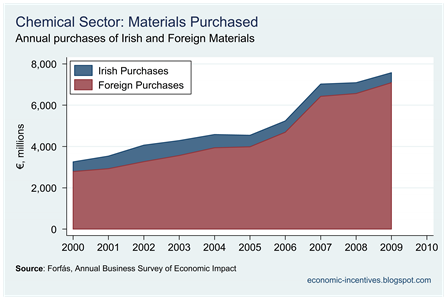

Of course, there is no way Chemicals companies in Ireland can generate nearly €40 billion of sales from just €3.1 billion of inputs. They do spend much more than than but the vast majority of it comes from abroad. First, let’s look at materials.

Only 6.4% of the €7.6 billion of materials purchased in 2009 came from Irish suppliers. The pattern of services purchases is not much different.

It may seem strange in a manufacturing industry that over 50% more is spend on service inputs than materials inputs but that is to forget that the most expensive input into the production of a pharmaceutical product is the cost of the patent. Import expenditure on patent royalties has been soaring in recent years.

These companies have been using more materials and more services in the period that has seen exports rise by more than 100%. But have they employed more workers? Erm, no.

In the period of this huge increase in exports total employment in the sector has fallen by 1,100 from 24,500 to 23,400, with most of this drop occurring in foreign owned companies. Although Irish companies generate only 1% of sales they do provide just over 10% of the employment (2,400 versus 21,000).

The numbers might be falling but total payroll has been rising and in 2009 was up almost 60% on the 200 level – up from €1 billion to €1.6 billion.

Falling employment numbers and rising payroll costs must mean that payroll costs per employee are rising and indeed they are, particularly in the foreign-owned sector. According to the Forfás data, the average payroll cost across all exporting manufacturing sectors was €49,800 in 2009. The sector that ranked highest was the chemicals sector with an average payroll cost of €68,300.

But don’t feeling sorry for these chemical companies. In the foreign-owned sector where average payroll costs are €71,200 the value added per employee (as defined by Forfás) is a staggering €934,700. Now that’s productivity.

All that aside, the key issue remains. Our export figures may provide the arithmetic for growth but it is likely that an “export-led growth” strategy will make little inroads into our unemployment crisis given that, over the last ten years, our most important trade export category has seen exports rise by over 100% and employment has fallen!

The Chemicals and Pharmaceutical category accounts for nearly 60% of our exports and these are generated by just 1% of the workforce.

No comments:

Post a Comment